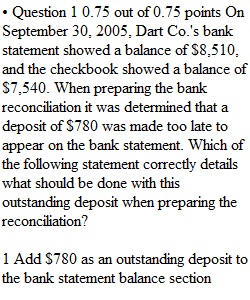

Q • Question 1 0.75 out of 0.75 points On September 30, 2005, Dart Co.'s bank statement showed a balance of $8,510, and the checkbook showed a balance of $7,540. When preparing the bank reconciliation it was determined that a deposit of $780 was made too late to appear on the bank statement. Which of the following statement correctly details what should be done with this outstanding deposit when preparing the reconciliation? • Question 2 0.75 out of 0.75 points On September 30, 2005, Dart Co.'s bank statement showed a balance of $8,510, and the checkbook showed a balance of $7,540. When preparing the bank reconciliation it was determined that $1,125 of outstanding checks had not been included in the September 30 bank statement. Which of the following statement correctly details what should be done with these outstanding checks when preparing the reconciliation? • Question 3 0.75 out of 0.75 points On September 30, 2005, Dart Co.'s bank statement showed a balance of $8,510, and the checkbook showed a balance of $7,540. When preparing the bank reconciliation it was determined that a debit memorandum for $25 for service charges was included with the bank statement but had not been recorded in Dart Co.'s books. Which of the following statement correctly details what should be done with this $25 service charge when preparing the reconciliation? • Question 4 0.75 out of 0.75 points On September 30, 2005, Dart Co.'s bank statement showed a balance of $8,510, and the checkbook showed a balance of $7,540. When preparing the bank reconciliation it was determined that Dart Co. had made an error in recording a deposit. The actual amount of the deposit should have been $910. However, Dart Co. recorded it in the checkbook as a deposit of $190.Which of the following statement correctly details what should be done with the $720 to correct Dart Co.'s error when preparing the reconciliation? • Question 5 0.75 out of 0.75 points When preparing a bank reconciliation, a debit memorandum for $200 was on Smythe Co.'s bank statment for a NSF check that was received from a customer. The check had been included in an earlier deposit when it was received from the customer. The NSF check had not been recorded previously by Smythe Co. Which of the following statement correctly details what should be done with this $200 NSF check when preparing the reconciliation?

View Related Questions